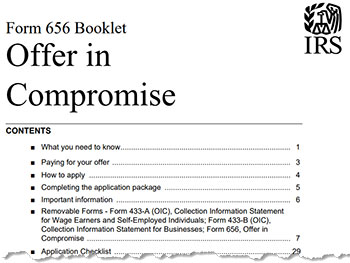

IRS Offer in Compromise

Taxpayers who can’t pay their full tax bill may qualify for an IRS “Offer in Compromise.”

An IRS offer in compromise allows taxpayers to settle their tax liability with the IRS for less than the full amount owed.

There are three grounds on which an IRS Offer in Compromise can be made:

In most cases, the IRS will not accept an Offer in Compromise unless the amount offered reasonably reflects collection potential. Essentially, the amount the taxpayer offers to settle must be what the IRS would reasonably collect. The IRS usually conducts an intensive review of a taxpayer’s financial information before acceptance of an offer. This includes assessing the value that can be realized from the taxpayer’s assets such as real property, automobiles, bank accounts, and anticipated future income.

We submit Offers in Compromise when a taxpayer’s financial information appears to support one. We do not waste a taxpayer’s time and money if we do not believe an offer will be accepted.

If the Offer in Compromise is accepted, taxpayers may choose to pay the offer amount in a lump sum (referred to as a “lump sum offer”) or in installment payments (referred to as a “periodic payment offer”).

If you would like for us to review the feasibility of an IRS Offer in Compromise, do not hesitate to contact us.

To learn more about IRS offer in compromise, download our free eBook.